Pruning your Portfolio

In this miniseries of blog posts we expand on the examples covered on from our Products that Count podcast with Melissa Pickering on Product Innovation in Recessions.

“Although salami slicing your portfolio is really important in a recession, do not kill your step change and disruptive innovations. If you do that, then your competitors will come in and steal your market share”

Recessions give you opportunity to focus, prune and tighten your brand and range offering.

Do tighten that portfolio; take out poor SKUs, merge and globalise others, drop poorer brands; do some triage on your range, brand focus and pipeline. Be more efficient. Be clear what your brand stands for and how its’ range is distinct from your peers.

But don’t stop innovating, your competitors will not.

Do not just make a cheap version of your product; that might devalue your brand and push away existing consumers.

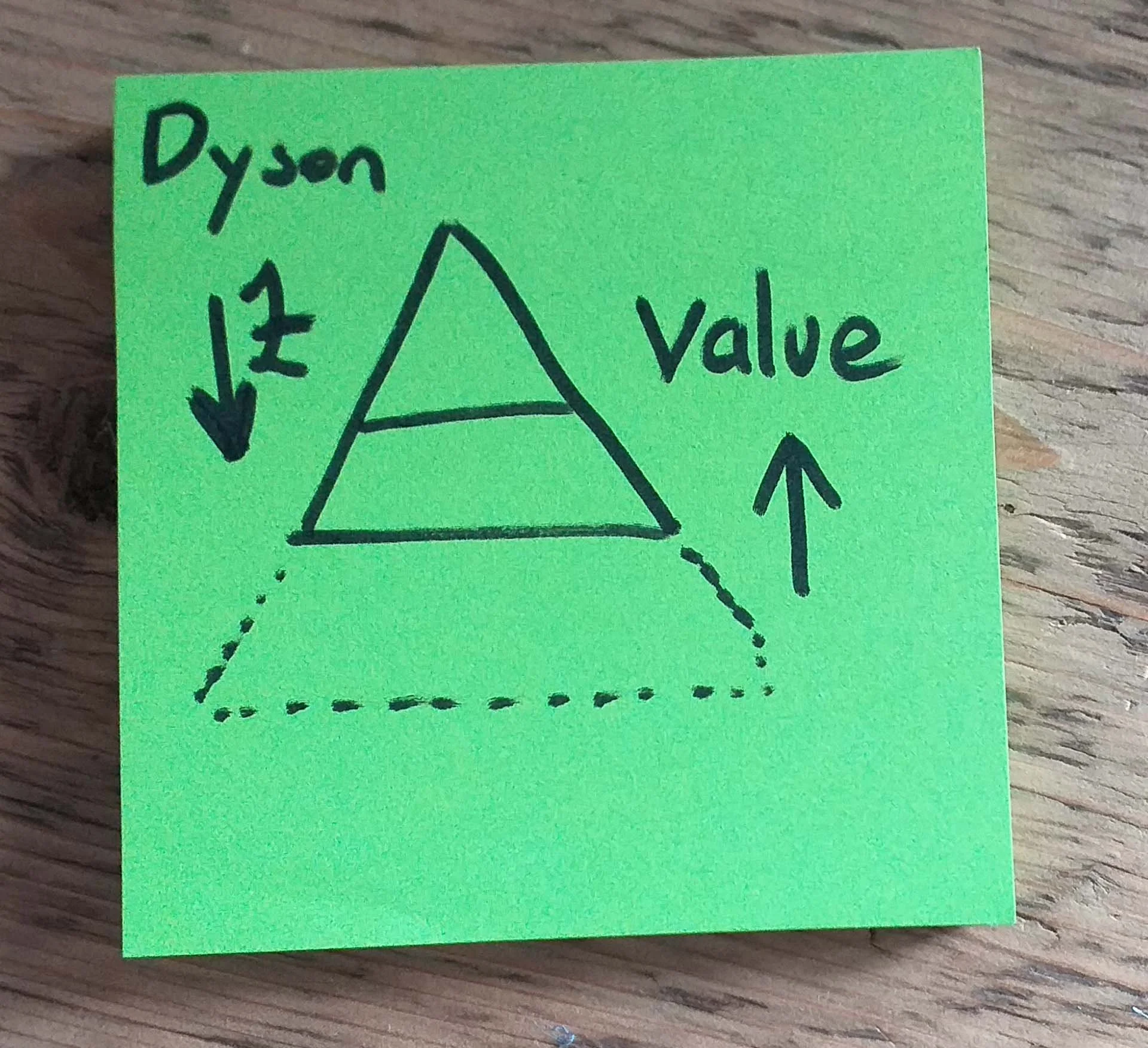

If you are a premium brand (e.g., Dyson), can you maintain or reduce your price point to keep users engaged & still buy $400 straighteners?

If you are a middle brand (Shark Ninja) do you have a broader span products to maintain brand value; and allow access

Such as:

· Value improving (VIP) last year’s lines for smaller pockets

· Offering the same product in small package (think ketchup).

· Rebadging OEM products

Are there OEM based products that you can rebadge (put your brand on) to offer a bigger value weight of sale or offer a broader lower cost base to attract people to your brand. This may have dual benefit of lower investment cost and lower cost (and hence RSP access).

We were able to deliver innovations faster and at lower risk, with better consumer benefits by adapting an OEM product, rather than fully inventing our own from scratch.

But!

It’s easy to kill off the high risk, more disruptive innovations; and focus on your core offering.

However often the core alone is sustaining your company, not driving significant growth.

So look at how you can deliver the step change innovations with lower risk, such as fugal testing, or is there an OEM (3rd party), who has 80% of your offering that you can partner with for lower risk, and greater speed.

“What I would emphasize is although salami slicing your portfolio Is really important in a recesion it drives resources and helps fund things.

Do not kill your step change and disruptive innovations, if you do that ,If you delay them or push them out your competition will come in and steal the market share. What you do need to do is thinking about developing in a frugal way or use slightly cheaper features to keep them within in the price point”

Summary

1. Prune out your portfolio to focus your brand and be more efficient.

2. Reduce price point and/or increase value in premium offerings.

3. Offer a lower cost, (but not cheap); entry level product.

4. Keep investing in next generation products.

5. Partner with OEMs to offer incremental lines and features.

For more examples; listen to Products that Count podcast with Ben Diamant and Melissa Pickering of Willow Innovations, VP of Product Management; on Spotify and iTunes